In recent months we’ve seen a dramatic increase in the number of enquiries regarding council tax at caravan parks. It seems that many local authorities (LA) are undertaking investigations at holiday parks to ensure that all owners are council tax payers elsewhere.

Static holiday caravans that are not used as sole or main residence are not classed as domestic property. It follows that these units are used to determine the holiday park’s rateable value, and this component is detailed within a regulation 4 notice. (See Business Rates article for advice)

Holiday caravans used in this way are not subject to council tax although the park owner may ask the caravan owner for a contribution towards the business rates.

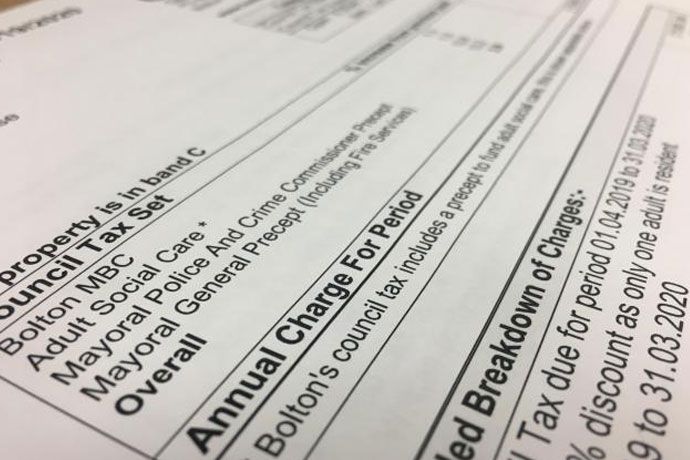

Static holiday caravans that are used as an individual’s sole or main residence may become subject to council tax as they are considered ‘dwellings’ by the local authority. It follows that these caravans or units are excluded from the determination of the rateable value. Caravans used in this way can become subject to council tax.

Payments made by the caravan owner with regard to ‘business rates’ at the caravan park are subject to the contract that exists between park owner and caravan owner – the Valuation Office Agency (VOA) and/or LA have no control over this matter.

Determining whether your holiday caravan is your sole or main residence should be pretty simple. If you live elsewhere in the UK or have residency or citizenship in another country you should be able to demonstrate that the caravan is being used for holiday and recreational purposes. It may be that you’re asked to provide documentary evidence of this and we’d advise that you cooperate with the request. While many of our members object to this ‘guilty until proven innocent’ regime, we think that if you can prove your holiday usage, you may as well! If you live abroad, but are not officially a resident of that country, this invariably won’t be enough.

Always take into account the implications of residential use under the terms of your agreement, if you have one. If you are presented with a situation such as the council asking for evidence of your main UK residence, please get in touch – we’re on hand to help and advise on the matter.

RELATED ARTICLES - static caravan advice

Published on 10 November 2017 By Dan Ellacott